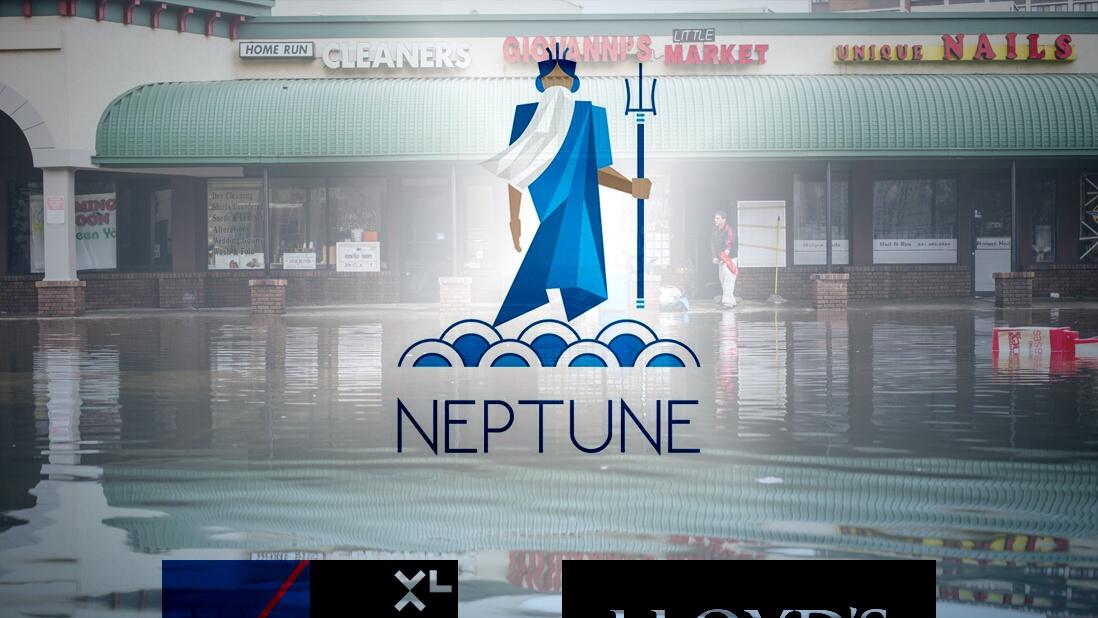

In the world of flood insurance, Neptune Flood stands out for offering potentially cheaper premiums compared to traditional options.

But with affordability comes questions. Why is Neptune flood insurance cheaper? What kind of coverage does it offer? Are there any drawbacks to consider?

This comprehensive guide delves into these questions and more, helping you decide if Neptune Flood is the right fit for your flood insurance needs.

Facts About Neptune Flood InsuranceWhy is Neptune Flood Insurance so cheap?

Neptune Flood Insurance might be cheaper than other options for a couple of reasons:

They use LiDAR technology for flood risk assessment, which is highly accurate.

This technology helps them identify properties at lower risk than traditional flood maps might indicate, potentially leading to lower premiums due to the perceived lower flood risk.

Neptune Flood is a private insurer, unlike FEMA’s National Flood Insurance Program (NFIP).

This private market focus gives them more flexibility in pricing based on their own risk assessments.

However, cheaper doesn’t always mean better. Consider the following before choosing Neptune:

Neptune is a relatively new company compared to the NFIP, so there is less data on how they handle claims.

NFIP policies may offer more comprehensive coverage in some cases.

It’s crucial to compare quotes from multiple providers, including the NFIP, to find the best coverage at the best price for your situation.

Background of Neptune Flood Insurance

Founded in 2016, Neptune Flood is a relatively new player in the flood insurance market.

Unlike the National Flood Insurance Program (NFIP) run by the Federal Emergency Management Agency (FEMA), Neptune Flood is a private insurer.

This distinction allows them more flexibility in pricing and risk assessment.

One of Neptune Flood’s key differentiators is its use of Light Detection and Ranging (LiDAR) technology.

LiDAR creates high-resolution, three-dimensional maps of the Earth’s surface, allowing for a more precise assessment of flood risk compared to traditional methods.

By potentially identifying properties at lower flood risk, Neptune Flood can offer lower premiums for those homeowners.

What does Neptune Flood Insurance cover?

Similar to other flood insurance policies, Neptune Flood offers coverage for:

- Building Coverage: Protects the structure of your home, including walls, foundation, and attached fixtures.

- Contents Coverage: Covers personal belongings damaged by floodwater, such as furniture, appliances, and electronics.

Neptune Flood allows you to customize your coverage by selecting separate limits for building and contents coverage. They also offer additional coverage options, like:

- Increased Building Value Coverage: For homes exceeding the standard coverage limit.

- Ordinance and Law Coverage: Covers the cost of bringing your home up to current building codes after a flood event.

- Deductible Buy-Down: Reduces your out-of-pocket expense in case of a flood claim (for an additional premium).

It’s important to note that flood insurance does not cover:

- Surface water damage: Damage caused by water entering your home through windows, doors, or leaks in the roof.

- Sewer backup: Overflow of sewage from drains due to heavy rain or flooding.

- Earth movement: Damage caused by earthquakes or mudslides.

For these types of events, you may need separate coverage from your standard homeowner’s insurance policy.

Why is Neptune Flood Insurance so cheap? Exclusions in Neptune Coverage

While Neptune Flood offers competitive rates, there are exclusions to be aware of:

- Limited Availability: Currently, Neptune Flood isn’t available in all areas. They primarily focus on coastal regions and areas with a high risk of flooding.

- Newer Technology: While LiDAR shows promise, it’s a relatively new approach to flood risk assessment compared to the NFIP’s established methods. There may be unforeseen factors LiDAR hasn’t fully accounted for yet.

- Claims Process: As a newer company, Neptune Flood’s claims handling process may not be as established as some competitors.

Weighing the Pros and Cons of Neptune Flood Insurance

Pros:

- Potentially Lower Premiums: Thanks to LiDAR technology and private market flexibility, Neptune Flood can offer lower rates for some properties.

- Streamlined Online Process: Getting a quote and purchasing a policy can be done quickly and easily online.

- Flexible Coverage Options: You can customise your policy with add-on coverage to fit your specific needs.

Cons:

- Limited Availability: Not available in all areas, especially those with lower flood risk.

- Newer Technology: LiDAR-based risk assessment is still evolving, and there may be unknown variables.

- Uncertain Renewal Rates: Renewal rates may be less predictable compared to established programs.

- Limited Customer Service Network: Customer service options might be less extensive.